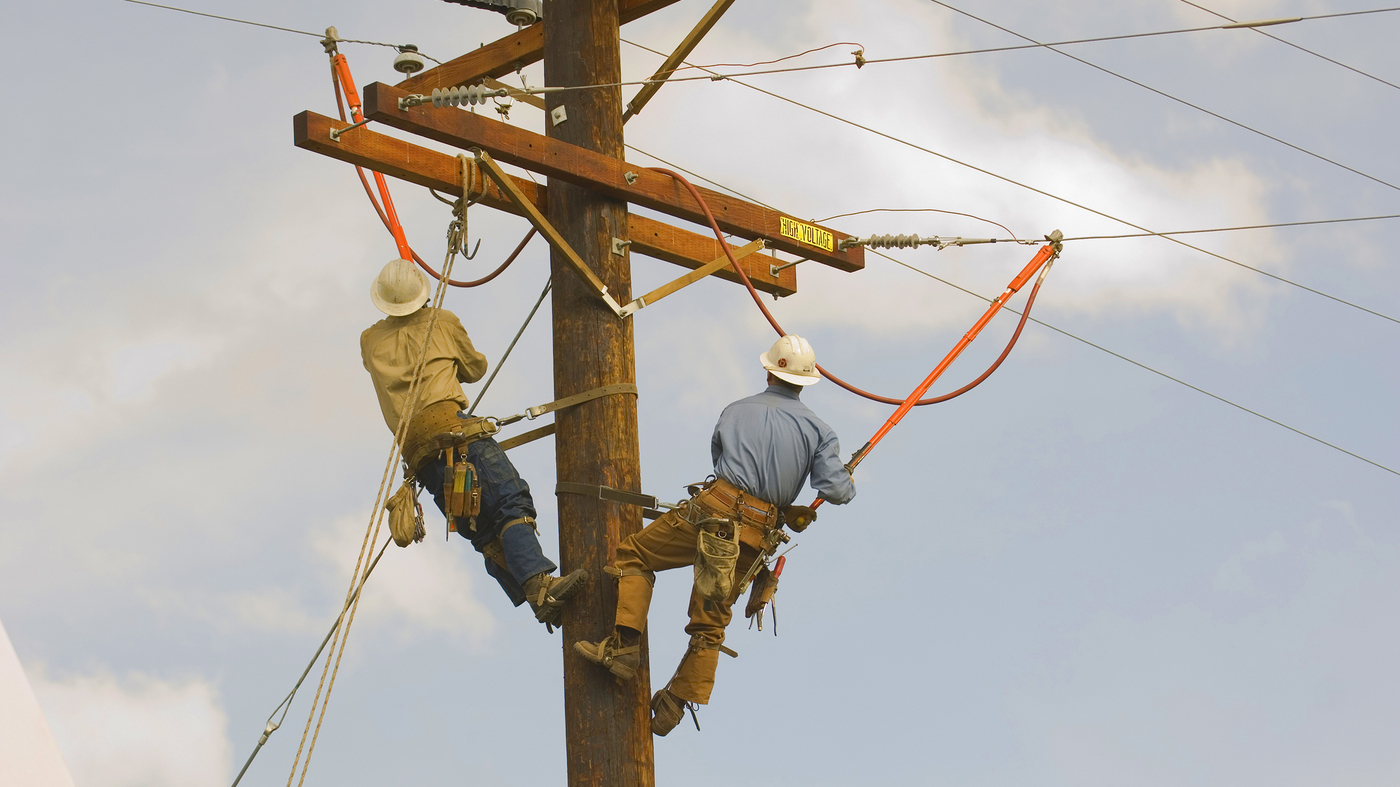

Long-term disability insurance can help if you are suddenly unable to work for an extended period of time due to illness, injury, or accident. Rich LaSalle/Getty Images Hide caption

Toggle caption Rich LaSalle/Getty Images

Long-term disability insurance can help if you are suddenly unable to work for an extended period of time due to illness, injury or accident.

Rich LaSalle/Getty Images

“It’s not going to happen to me.” Perhaps this sentiment explains many employees’ attitudes toward long-term disability insurance, which pays a portion of your income if an illness, injury or accident causes you to suddenly be unable to work for an extended period of time.

In a survey conducted this year by LIMRA, an association of financial services and insurance companies, 65% of respondents said most people need disability insurance. But when asked if they personally thought it was a necessity, that figure dropped to 48%. When asked if they actually had disability insurance, that percentage dropped to 20%.

Long-term disability insurance usually has a three or six month waiting period before benefits are paid. That period is covered if you have short-term disability insurance.

As the annual benefits enrollment season begins for many companies, disability insurance may be one option worth looking at.

Some employers may require you to pay a larger percentage than before, or even the full amount, and taking out this insurance could have hidden benefits later on.

Or you may find that your employer automatically enrolls you, or will enroll you, unless you opt out. Because insurance companies typically require a minimum level of employee participation in order to offer a plan, more and more employers are taking that route to expand coverage that they believe is best for their employees — and for themselves.

Benefits consultants agree that while long-term disability coverage doesn’t have the novelty appeal of other benefits companies have been offering recently (such as pet insurance), it could prove to be much more valuable in the long run.

“This is a really important safety net benefit.” Rich FurstenbergSenior partner at human resources consultancy Mercer.

If you become disabled due to an accident, injury, or illness, long-term disability insurance will usually pay 50 to 60 percent of your income while you are unable to work. The length of time the policy pays out varies, with some policies paying out until you turn 65.

The majority of long-term disability compensation claims relate to chronic problems such as cancer and musculoskeletal conditions, and according to the Disability Awareness Council, the average length of a claim is around three years, or 34.6 months.

Not everyone has the savings to get through that period: In a 2015 Federal Reserve survey of adults about their finances, 53% said they didn’t have an emergency fund large enough to cover even a three-month bill. Even more alarming, nearly half of respondents (46%) said they didn’t have enough cash to cover a hypothetical $400 emergency expense.

According to the Social Security Administration, one in four 20-year-olds today will become disabled before age 67.

Overall, 41 percent of employers offer long-term disability insurance, although larger companies typically offer it at a much higher rate, according to LIMRA. Compared to health insurance, premiums are tiny — averaging $256 per year in 2016 for group plans, according to LIMRA. Many employers pay the full cost of premiums or charge employees a small fee.

But as employers continue to push the costs of various benefits onto workers’ shoulders, long-term disability insurance is no exception. Increasingly, employers are offering insurance as an “optional” benefit, with employees paying the full premiums.

The advantage is that employees pay the premiums themselves with after-tax money, and if they become disabled and need to use the insurance, the benefits are paid tax-free.

“It’s better for employees if they have the choice to pay their premiums post-tax or voluntary,” said Jackie Reinberg, national practice leader for absence, disability management and life insurance at employee benefits consultancy Willis Towers Watson.

Some employers pay a basic benefit covering 40 or 50 percent of earnings and offer workers the opportunity to “upgrade” to more generous earnings coverage of 60 or 70 percent.

Although there are tax benefits to voluntary enrollment, disability consultants worry that leaving it up to employees makes them more likely to skip buying long-term disability insurance, especially when choosing between several other voluntary enrollment options, such as cancer insurance, critical illness insurance and, of course, pet insurance.

“All these policies feel the same, and if people have to choose one, they tend to choose the cheapest one, the one they’re most likely to use,” says Carol Hartnett, president of the Disability Awareness Council, a membership organization for disability insurers that educates and advocates on disability issues.

Automatic enrollment can make a big difference: Employers who automatically enroll employees in voluntary long-term disability insurance can achieve a 75% participation rate among employees, compared with just 30% for those who leave it entirely up to employees, says Mike Simmons, CEO of disability insurer Unum US.

If you were offered long-term disability insurance when you were hired but didn’t sign up, it may be harder to get it during open enrollment, Furstenberg said.

An increasing number of health insurance plans require employees to provide “proof of eligibility” and answer a series of health questions before being approved. Some long-term disability policies have pre-existing condition provisions that, for example, may not pay benefits for certain medical conditions for up to a year.

Kaiser Health News is an editorially independent news service that is part of the nonpartisan Henry J. Kaiser Family Foundation. Follow Michelle Andrews on Twitter: translator.