Tech magnate David Ellison’s months-long effort to acquire a controlling stake in Paramount Global moved closer to the finish line on Sunday, a deal that marks the start of a new chapter for the long-struggling media company and parent company of Hollywood’s oldest film studio.

Paramount Global’s board on Sunday approved a proposed acquisition of the Redstone family’s Massachusetts holding company, National Amusements Corp., by Ellison’s Skydance Media and its backers, according to two people familiar with the deal who declined to comment.

A Paramount spokesman declined to comment.

The Redstones’ voting shares in Paramount will be transferred to Skydance, and the deal’s main backer, Mr. Ellison, the son of billionaire Oracle co-founder Larry Ellison, will gain control of the media business, which includes Paramount Pictures, broadcast network CBS, cable stations MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion, multi-faceted deal also includes merging Ellison’s production companies into the storied media company, giving it an improved ability to compete in today’s media environment.

The agreement, which marks Mr. Ellison as a Hollywood heavyweight, comes in the past two weeks as Mr. Ellison and his financing partners renewed efforts to secure the support of the Redstone family and Paramount’s independent directors.

Shari Redstone far preferred Ellison’s proposal to those of other potential buyers, believing the 41-year-old entrepreneur had the ambition, experience and financial backing to pull Paramount out of its slump.

But in early June, Redstone backed down and abruptly walked away from the deal with Ellison, a move that surprised industry observers and Paramount insiders because Redstone had been in charge of the auction.

Within about a week, Ellison resumed his lobbying of Redstone. Ellison eventually convinced Redstone to sell off the entertainment company his family has run for nearly 40 years. The lucrative deal paid the Redstone family about $50 million more than was offered in early June. On Sunday, Paramount’s full board of directors, along with a special committee of independent directors, approved the deal, the people said.

Under the terms of the deal, Skydance and its financial partners, RedBird Capital Partners and private equity firm KKR, have agreed to inject $1.5 billion in cash to help Paramount repay its debt, with $4.5 billion earmarked for buying out Paramount’s Class B shareholders who are eager to exit.

The Redstone family will receive $1.75 billion from National Amusements, which owns Paramount and a chain of regional cinemas founded during the Great Depression, after the company’s heavy debt is paid off.

The proposed sale marks the end of the Redstone family’s nearly four-decade reign as one of America’s most famous and contentious media dynasties. The late Sumner Redstone’s National Amusements was once valued at nearly $10 billion but its fortunes have plummeted due to pandemic-related theater closures, last year’s Hollywood labor strike and heavy debt.

The New York-based company has lost two-thirds of its value over the past five years. Based on Friday’s closing price of $11.81 a share, its shares are now worth $8.2 billion.

Faced with various hardships, Shari Redstone was forced to part with some of her most treasured family heirlooms. Additionally, National Amusements was struggling to pay off its debts, and high interest rates worsened the Redstone family’s prospects.

Paramount boasts some of the entertainment industry’s oldest brands, including the 112-year-old Paramount Pictures film studio and is known for groundbreaking films such as “The Godfather” and “Chinatown.” The company owns television stations such as KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Once-bustling cable channels such as Nickelodeon, TV Land, BET, MTV and Comedy Central have lost viewers.

The transfer requires approval from federal regulators, a process that could take months.

Paramount’s independent board of directors said in May it was considering a competing $26 billion takeover bid from Sony Pictures Entertainment and Apollo Global Management L.P. The offer would have forced all of Paramount’s shareholders out of business and paid down the company’s debt, but Sony executives had grown increasingly wary of buying a company so dependent on traditional TV channels.

Warner Bros. Discovery expressed interest in merging with or acquiring CBS earlier this year, but the company is in similar straits to Paramount, with nearly $40 billion in debt from past deals. Media mogul Byron Allen has also expressed interest.

Skydance Media founder and CEO David Ellison won the bid to buy Paramount.

(Evan Agostini/InVision/The Associated Press)

Many Hollywood producers, writers, agents and others had been cheering on the Skydance acquisition, believing it was the best chance to keep Paramount as an independent company. Apollo and Sony were expected to split off Paramount, with Sony absorbing the film studio into its Culver City division.

In a second phase of the deal, Paramount would absorb Ellison’s Santa Monica-based Skydance Media, which produces sports, animation and games as well as TV shows and films.

Ellison is expected to lead Paramount as its chief executive. Former NBCUniversal CEO Jeff Shell, who is now a Redbird executive, may help run the company. It’s unclear whether the Skydance team will retain the three division heads who currently run Paramount: Paramount Pictures CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Entertainment Studios chief Chris McCarthy.

Skydance already has a relationship with Paramount: The company has co-produced each of the Mission: Impossible films since 2011’s “Mission: Impossible – Ghost Protocol,” starring Tom Cruise, and is also investing in the 2022 blockbuster “Top Gun: Maverick,” starring Cruise.

Ellison first approached Redstone about a deal last summer, and the talks became public in December.

Ms. Redstone had always considered Mr. Ellison a preferred buyer because the deal would have provided her family with a severance package, and she was impressed with the media mogul, believing he could be the next generation of leader who could take the company her father built to greater heights, according to people familiar with her thinking.

Larry Ellison is said to be financing the deal.

Analysts say David Ellison was attracted to the deal because of his past collaborations with Paramount Pictures, the allure of combining the two companies’ intellectual property and the prestige of owning a storied studio, whose rich history includes popular franchises such as “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is one of the oldest Hollywood studios with a huge number of studios. [intellectual property]”The intent seems to be for Ellison to take the capital he has and what he’s built with Skydance and leverage it to own a major Hollywood studio,” Brent Penter, a senior researcher at Raymond James, said before the deal, “not to mention the networks and everything else that Paramount owns.”

The agreement prepares to bring to an end the Redstone family’s 37-year tenure at the company, formerly known as Viacom, which began with a hostile takeover by Sumner Redstone in 1987.

Seven years later, Mr. Redstone acquired a controlling stake in Paramount after financing a $10 billion acquisition of Viacom Inc., an eventual bankrupt video-rental chain called Blockbuster Inc. Mr. Redstone had long viewed Paramount as a crown jewel, a belief solidified a half-century ago when he negotiated theatrical release terms that allowed Paramount to show its storied films in his own regional cinema chains.

Under Redstone’s stewardship, Paramount won Oscars in the 1990s for “Forrest Gump” and “Saving Private Ryan.”

He pioneered the idea of treating films as an investment portfolio and hedging your investments in some productions by teaming up with financial partners, a strategy now widely adopted across the industry.

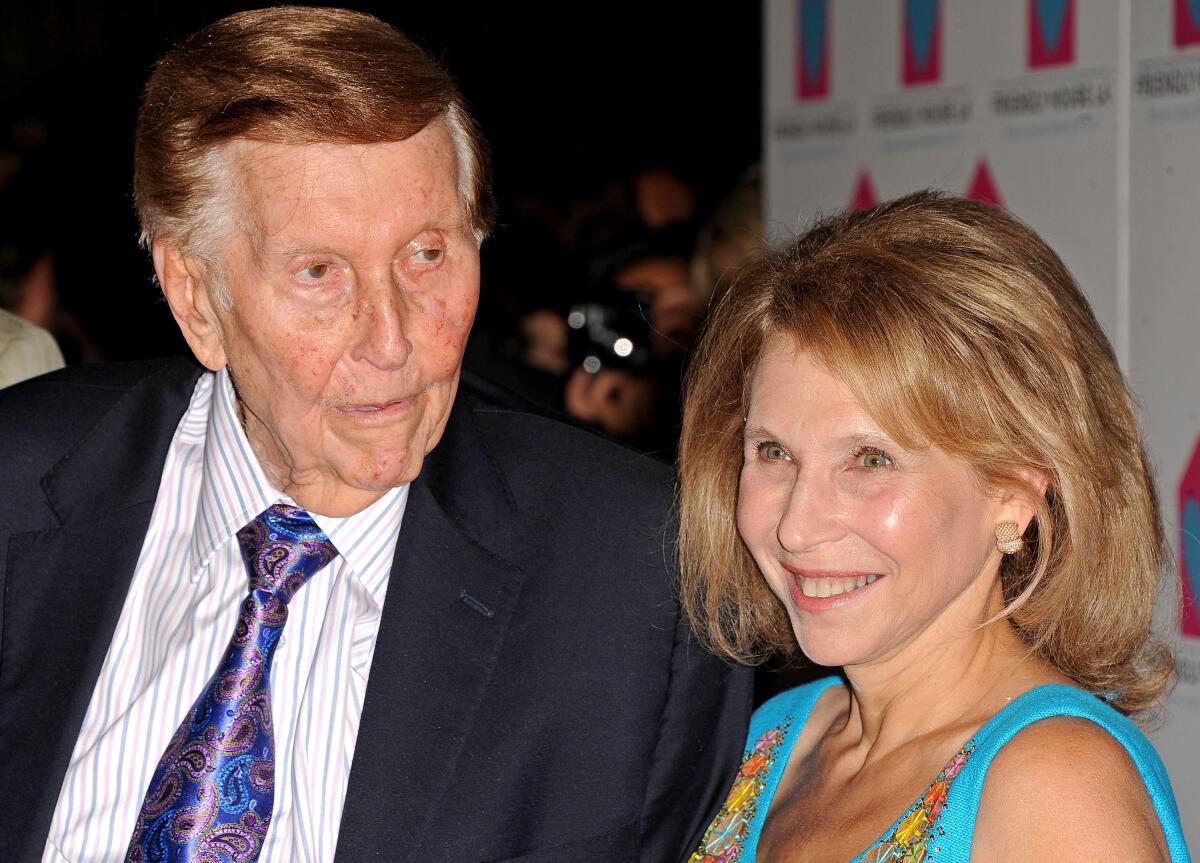

The late Sumner Redstone and his daughter Shari Redstone have held a controlling stake in Viacom, which was rebranded as Paramount, since 1987 through the family holding company National Amusements Inc.

(Katie Winn/InVision/The Associated Press)

In 2000, Redstone expanded his media empire again with the acquisition of CBS, which made Viacom one of the most powerful media companies of its time, competing with Walt Disney Co. and Time Warner Inc. Just six years later, Redstone split the company into separate sister companies, convinced that Viacom’s younger audience made it more valuable to advertisers, and he also wanted to make a profit from both companies.

After years of mismanagement at Viacom, a combination of Redstone’s failing health and board turmoil led his daughter to oust Viacom’s top management and board members. Three years later, in the wake of the CBS executive misconduct scandal, Shari Redstone achieved her goal by reuniting CBS and Viacom in a nearly $12 billion deal.

The combined company, then called ViacomCBS, was expected to be valued at more than $25 billion and become a TV powerhouse with a large share of TV advertising revenue through its control of CBS and more than two dozen cable channels.

But changes in the television industry have dealt a major blow.

As consumer cord-cutting becomes widespread and television advertising revenues decline, ViacomCBS’s largest asset has become a significant liability.

The company was a late entrant into the streaming wars, then spent heavily on its streaming service Paramount+ in an attempt to catch up with Netflix and Disney. (Early 2022, the company changed its name to “Paramount Global” as a nod to its filmmaking past and to tie it to the streaming platform of the same name.)

The company’s declining traditional TV business, falling TV advertising revenue and struggles to monetize streaming will pose major challenges for Ellison when he takes over at Paramount, which is still profitable despite traditional TV being in decline.

And while streaming is a totally different economic proposition than TV and the margins are slimmer, the company also faces larger questions from across the industry about when, if at all, box office revenue will return to pre-pandemic levels.

“This company is running on hope,” says Stephen Galloway, dean of the Dodge School of Film and Media Arts at Chapman University, “and hope is not a good business strategy.”