While most people with Medicare are adults age 65 or older, Medicare also covers millions of younger people who qualify for Medicare based on having a long-term disability, or diagnosis with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease). In 2022, 7.7 million people under age 65 with disabilities were covered by Medicare, representing 12% of all Medicare beneficiaries. Younger beneficiaries who qualify for Medicare because of disability are more likely than those who qualify based on age to have lower incomes and education levels, to be Black or Hispanic, and to be in worse health.

Medicare covers the same benefits for people of all ages, regardless of how they qualified for Medicare, and Medicare coverage options and financial assistance programs are generally the same – the main exception being that people under age 65 with disabilities do not have a guaranteed issue right to purchase Medigap supplemental policies. However, perhaps related to their different pathways to Medicare eligibility and because the program was originally designed to cover older adults, with coverage for younger people with disabilities added later, Medicare generally does not work as well for people under age 65 with disabilities. This conclusion is based on KFF analysis of surveys dating back to 2008 but not more recent than 2019. According to previous analysis, beneficiaries under age 65 with disabilities have reported worse access to care, more cost concerns, and lower satisfaction with care than those age 65 or older.

To get a more current understanding of how Medicare is working for older adults and younger people with disabilities, this brief analyzes data from the 2023 KFF Survey of Consumer Experiences with Health Insurance, a nationally representative survey of 3,605 U.S. adults with health insurance. This brief focuses specifically on the 885 adults with Medicare, including 165 adults under the age of 65 with disabilities.

This analysis provides a window into the challenges facing people with disabilities as they navigate the health insurance system by focusing on the experiences of younger adults on Medicare who qualify for the program due to having a long-term disability. The analysis highlights the ways in which beneficiaries under age 65 with disabilities may be less well served by the Medicare program than older beneficiaries. (While people with disabilities are also included among the population of Medicare beneficiaries age 65 or older, the survey sample is insufficient to focus on this group specifically.) People with disabilities who are covered by private insurance or Medicaid are likely to face similar challenges using their coverage. Insights from this analysis could help to inform efforts to strengthen the Medicare program, particularly for younger adults with disabilities.

Key Takeaways

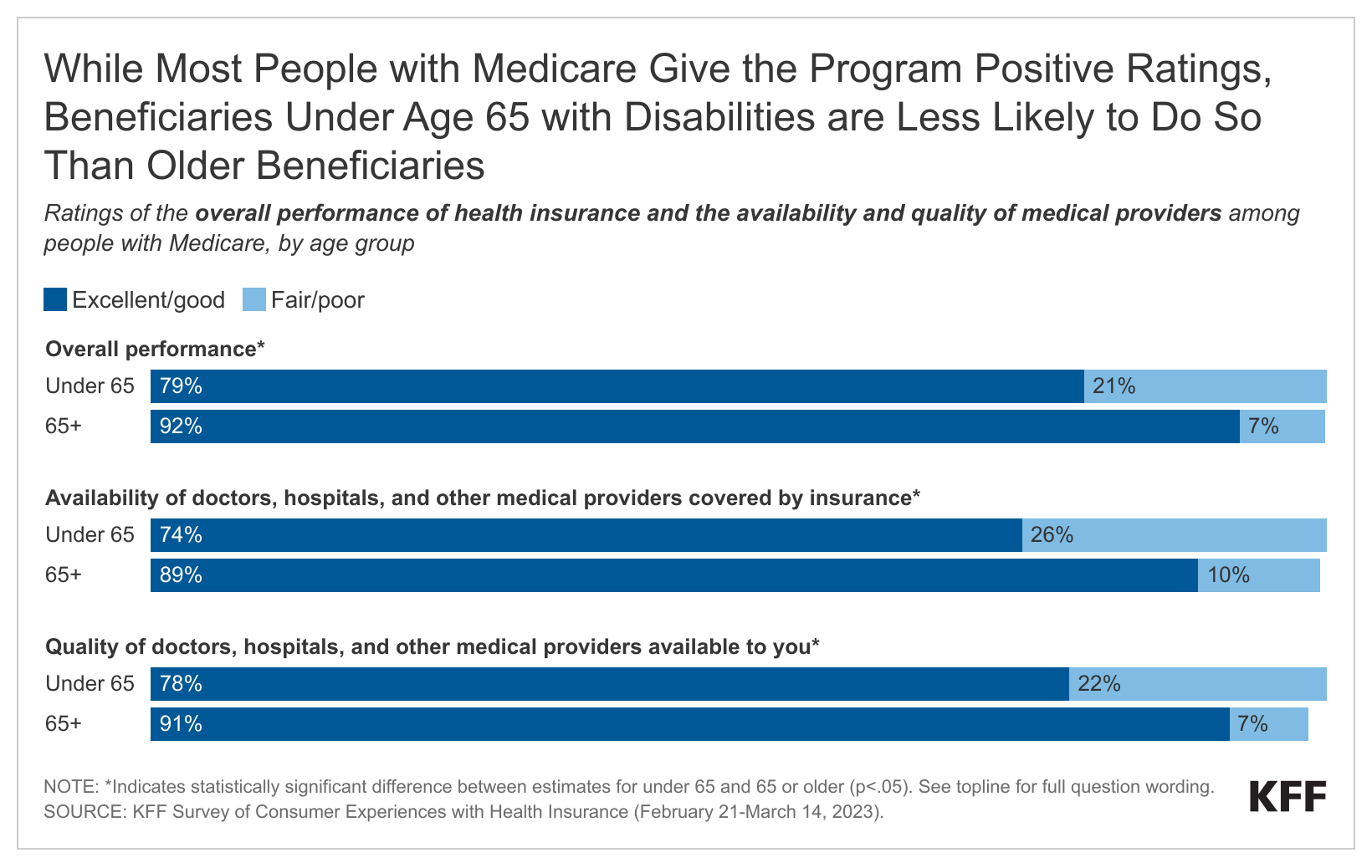

Overall, people with Medicare are more satisfied with their health insurance coverage than adults with other types of insurance, but among people with Medicare, those under age 65 with disabilities are less likely than those age 65 or older to give positive ratings to the overall performance of their insurance coverage (79% vs. 92%) and some features of it, such as the quality and availability of providers.

Overall, a majority of Medicare beneficiaries under age 65 with disabilities say they experienced a problem with their health insurance in the last year (70%), compared to half (49%) of those age 65 or older. This includes a larger share of those under age 65 with disabilities who say they experienced denials or delays in getting prior approval (27% vs. 9%) or insurance not paying for care they received that they thought was covered (24% vs. 8%).

A relatively small share of all Medicare beneficiaries who said they had a problem with health insurance in the past year reported difficulty accessing care as a direct result of these problems, but access problems were more likely to be reported by Medicare beneficiaries under age 65 with disabilities than those 65 or older. At least one in five Medicare beneficiaries under age 65 with disabilities who reported problems say they were unable to receive recommended treatment (24%) or experienced significant delays in receiving medical care or treatment (21%), compared to very small shares of those 65 or older who said the same (6% for both).

Medicare beneficiaries under 65 with disabilities were more likely to experience difficulty with the health insurance enrollment process and comparing insurance options compared to beneficiaries age 65 or older, including figuring out if their income qualifies them for financial assistance (30% vs. 11%).

Cost concerns related to insurance are an issue for Medicare beneficiaries of all ages, particularly when it comes to monthly premiums and out-of-pocket costs for prescription drugs, but a larger share of people with Medicare under age 65 with disabilities than those age 65 or older report certain problems. More than one in three people with Medicare under age 65 with disabilities report they had a problem paying a medical bill in the past 12 months (35%), compared to one in ten (9%) of those 65 or older. People with Medicare under age 65 with disabilities were also more likely to report delaying or going without specific health care services due to cost, such as dental care (42% vs. 24%), prescription drugs (18% vs. 10%), and doctor visits (14% vs. 4%).

About half of people with Medicare under age 65 with disabilities self-report fair or poor physical health, compared to 19% of those age 65 or older, since, by definition, people under age 65 qualify for Medicare based on having a long-term disability. The higher rate of poorer self-reported health among beneficiaries under age 65 could contribute to a higher rate of health insurance problems.

Three in 10 people with Medicare under age 65 with disabilities self-report fair or poor mental health status, compared to 1 in 10 (9%) of those age 65 or older, and a larger share also report problems related to mental health care availability and access, including reporting that there was a mental health therapist or treatment they needed that wasn’t covered by insurance (27% vs. 7%), and being unable to receive mental health services or medication in the past year they thought they needed (18% vs. 5%).

Satisfaction with Coverage

People with Medicare are more satisfied with their health insurance coverage than those with employer-sponsored insurance, Marketplace coverage, and Medicaid. And while majorities of people with Medicare of all ages rate Medicare positively, those under age 65 with disabilities are less likely than older beneficiaries to give positive ratings to Medicare and some features of it. While 92% of beneficiaries age 65 or older rate Medicare’s performance positively, a smaller share, but still a majority (79%) of Medicare beneficiaries under 65 with disabilities rated Medicare’s performance as excellent or good (Figure 1). A smaller share of Medicare beneficiaries under 65 with disabilities than those 65 or older rated both the availability and the quality of doctors, hospitals, and other medical providers as excellent or good.

Problems with Health Insurance

Overall, a somewhat smaller share of people with Medicare than people with employer-sponsored insurance, Marketplace coverage, or Medicaid report experiencing any problems with their health insurance in the past 12 months (51% compared to 60%, 56%, and 58%, respectively). Among Medicare beneficiaries, a majority (70%) of those under age 65 with disabilities say they experienced any problem, compared to half (49%) of those 65 or older. Because a larger share of beneficiaries under age 65 with disabilities report that they are in fair or poor physical and mental health and have severe chronic conditions compared to beneficiaries age 65 or older (Appendix Figure 1), those under age 65 with disabilities may be more likely to have multiple encounters with the health care system during the year and encounter specific problems when they do.

For example, more than one-fourth (27%) of Medicare beneficiaries under age 65 with disabilities said their health insurance denied or delayed prior approval for a treatment, service, visit, or drug before they received it, compared to just under one in 10 (9%) beneficiaries 65 or older (Figure 2). Similarly, a larger share of beneficiaries under 65 with disabilities than those 65 or older reported that their insurance didn’t pay for care they received that they thought was covered (24% vs. 8%). But one problem, in particular, was reported by a similar share of both groups: 34% of beneficiaries under age 65 with disabilities and 26% of those age 65 or older reported that insurance didn’t cover or required a high copay for a prescription drug.

To the extent that people under 65 with disabilities are seeking medical care more often, or seeking more specialized medical care, than those age 65 or older, insurance problems could be exacerbated for those under age 65 who are enrolled in Medicare Advantage plans, which may have limited networks of doctors and hospitals and can impose prior authorization requirements on Medicare-covered services. (Due to sample size limitations, this analysis by age group is not able to be stratified by enrollment in traditional Medicare and Medicare Advantage.)

Experiences with Enrollment and Comparing Options

Medicare beneficiaries under age 65 with disabilities are more likely to experience difficulty with the Medicare enrollment process and comparing Medicare coverage options compared to beneficiaries age 65 or older. The percentage of beneficiaries under 65 with disabilities who had difficulty enrolling in Medicare (26%) or figuring out if their income qualified them for financial assistance (30%) was substantially larger than among those 65 or older (10% and 11%, respectively) (Figure 3). Similarly, nearly a quarter of those under 65 with disabilities reported that it was somewhat or very difficult to find insurance to meet their needs (23%), compared to 14% of those age 65 or older. This difficulty could reflect the wide array of coverage options that Medicare beneficiaries face, including the choice of whether to enroll in traditional Medicare or Medicare Advantage, and choosing among Medicare Advantage and Part D drug plan options. It might also reflect difficulties among low-income beneficiaries related to enrolling in Medicaid, the Medicare Savings Programs, or the Part D Low-Income Subsidy program for additional benefits and financial assistance.

Understanding of Insurance

Overall, a smaller share of people with Medicare than those with other types of insurance report difficulty understanding various aspects of health insurance, but among those with Medicare, a larger share of people under 65 with disabilities than those age 65 or older say they find it difficult to understand various aspects of health insurance. Specifically, Medicare beneficiaries under 65 with disabilities are more likely to say they have difficulty understanding specific insurance terms such as “deductible” and “prior authorization” (34% vs. 17%), how much they will have to pay out-of-pocket when they use health care (32% vs. 18%), insurance statements outlining whether care will be covered and how much insurance will pay (31% vs. 17%), and how to find information on which providers are covered in their insurance network (28% vs. 13%) (Figure 4).

Consequences of Problems with Health Insurance

Overall, a relatively small share of Medicare beneficiaries who said they had any problem with health insurance in the past 12 months reported delays getting (9%) or being unable to get medical care (9%) as a direct result of these problems, but these access problems were more likely to be reported by Medicare beneficiaries under age 65 with disabilities than those 65 or older. Among the 70% of people under age 65 with disabilities with Medicare who said they had a problem with insurance in the past 12 months, nearly one fourth (24%) reported they were unable to receive care in the past 12 months as a direct result of these problems. By comparison, among the 49% of people age 65 or older on Medicare, 6% reported being unable to receive care as a result (Figure 5). Similarly, among Medicare beneficiaries who had a problem with their insurance in the past year, a much larger share of those under age 65 with disabilities than those age 65 or older reported delays in receiving care in the past 12 months due to health insurance problems (21% vs. 6%).

Experiences Related to Mental Health Care

People with Medicare under age 65 with disabilities are more likely than those age 65 or older to report problems related to mental health care availability and access. Three in 10 (30%) of Medicare beneficiaries under age 65 with disabilities self-report fair or poor mental health status compared to 9% of those age 65 or older, making it more likely that they would seek mental health treatment (Appendix Figure 1). This could be a factor in greater dissatisfaction among people with Medicare under age 65 with disabilities when it comes to both the availability and quality of mental health therapists and professionals covered by their insurance: those under 65 with disabilities are more likely than those 65 or older to rate insurance as fair or poor when it comes to the availability (37% vs. 20%) and the quality (35% vs. 16%) of mental health providers covered by insurance (Figure 6).

Furthermore, more than a quarter (27%) of Medicare beneficiaries under 65 with disabilities reported there was a mental health therapist or treatment they needed that wasn’t covered by insurance, and nearly 1 in 5 (18%) said they were unable to receive mental health services or medication in the past year they thought they needed. Substantially smaller shares of beneficiaries age 65 or older reported these problems (7% and 5%, respectively). (Due to sample size restrictions, this analysis by age group is not able to be stratified by mental health status or limited to those who rate their mental health as fair or poor).

Affordability Concerns

Cost concerns related to insurance are an issue for Medicare beneficiaries of all ages, particularly when it comes to monthly premiums and out-of-pocket costs for prescription drugs. Overall, around one-fourth of Medicare beneficiaries gave their insurance a “fair” or “poor” rating on these measures. However, some cost concerns are experienced by a larger share of people with Medicare under age 65 with disabilities than those age 65 or older, which is likely related to a substantially greater percentage of those under age 65 with disabilities having incomes below 200% of poverty compared to those age 65 or older (77% vs. 44%) (Appendix Figure 1). For example, 36% of those under 65 with disabilities gave a negative rating to their insurance when it comes to the out-of-pocket cost they have to pay to see a doctor, compared to 19% of those 65 or older (Figure 7). Similarly, over one-third (35%) of people under age 65 with disabilities said that in the past year they had problems paying or were unable to pay any medical bills, compared to one in 10 (9%) of those age 65 or older.

Overall, a small share of Medicare beneficiaries report delaying or going without doctor’s visits or prescription drugs in the past year due to cost, but these percentages increase somewhat when it comes to services that Medicare doesn’t cover, especially dental care. Nearly one fourth (24%) of Medicare beneficiaries age 65 or older say they delayed or went without dental care in the past year due to cost, and this share rises to 42% among those under age 65 with disabilities (Figure 8). Similarly, larger shares of people with Medicare under age 65 with disabilities than those age 65 or older say they delayed or went without vision services, which are also not covered by Medicare (25% vs. 13%), prescription drugs (18% vs. 10%), and doctor’s office visits (14% vs. 4%) in the past year because of cost.

Conclusion

Results from the 2023 KFF Survey of Consumer Experiences with Health Insurance show people with Medicare are more satisfied with their health insurance coverage than those with other types of insurance, but among people with Medicare, those under age 65 with disabilities are less likely than those age 65 or older to rate Medicare positively when it comes to the overall performance of their insurance and various features of it. Medicare beneficiaries under age 65 with disabilities are more likely than those age 65 or older to experience access and cost problems when using their insurance.

Because a larger share of people with Medicare under age 65 with disabilities report that they are in fair or poor physical and mental health and have severe chronic conditions compared to people age 65 or older, those under age 65 with disabilities may be more likely to have multiple encounters with the health care system during the year and encounter problems when they do. And with a greater share of beneficiaries under age 65 with disabilities than those 65 or older having relatively low incomes, people under age 65 are more likely to have problems affording health care costs.

Addressing areas of particular concern for beneficiaries under age 65 with disabilities – including policies that address issues related to provider access and availability, improve the process of comparing plans and enrolling, enhance understanding of various features of Medicare, including out-of-pocket costs and provider network restrictions (for Medicare Advantage plans), and improve access to financial assistance programs that help with affordability – could lead to better experiences with Medicare for beneficiaries under age 65 with disabilities.

This work was supported in part by the Robert Wood Johnson Foundation. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

This KFF Survey of Consumer Experiences with Health Insurance was designed and analyzed by researchers at KFF. The survey was designed to reach a representative sample of insured adults in the U.S. The survey was conducted February 21–March 14, 2023, online and by telephone among a nationally representative sample of 3,605 U.S. adults who have employer sponsored insurance plans (978), Medicaid (815), Medicare (885), Marketplace plans (880), or a Military plan (47). The Medicare sample includes 720 respondents age 65 or older and 165 respondents under age 65 with disabilities. The margin of sampling error is plus or minus 2 percentage points for the full sample, and plus or minus 4 percentage points for adults with Medicare. The margin of sampling error is plus or minus 11 percentage points for adults under the age of 65 with Medicare and plus or minus 5 percentage points for adults age 65 or older with Medicare. For results based on other subgroups, the margin of sampling error may be higher.

The sample includes 2,595 insured adults reached through the SSRS Opinion Panel either online or over the phone (n=75 in Spanish). Another 504 respondents were reached online through the Ipsos Knowledge Panel. Another 289 (n=10 in Spanish) interviews were conducted from a random digit dial (RDD) of prepaid cell phone numbers (n=190) and landline telephone numbers (n=99). An additional 217 respondents were reached by calling back respondents who said they were insured in previous KFF probability-based polls.

Respondents were weighted separately to match each group’s demographics using data from the 2021 American Community Survey (ACS). Weighting parameters included gender, age, education, race/ethnicity, and region.

For full details on the survey methodology, see the Methodology tab of the KFF Survey of Consumer Experiences with Health Insurance.