Fast Facts

Seniors and people with disabilities are commonly more susceptible to financial difficulties, so it’s important to help them understand and manage their finances.

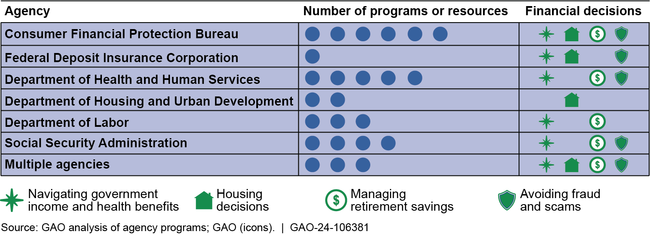

We found 24 examples of federal financial literacy programs aimed at these groups, including curricula teaching seniors about fraud and financial information for people with disabilities.

The Commission coordinates the federal government’s efforts to improve financial literacy, but its reports are unclear about how well these programs are working. We recommended that the Commission improve its reporting to help Congress and agencies determine whether these programs are leading to improved financial literacy.

highlight

GAO findings

Seniors and people with disabilities face financial decisions that can have lasting effects on their financial well-being. They deal with a variety of issues, including navigating government benefits such as Social Security and Medicare, making housing decisions, managing retirement savings, and avoiding fraud. GAO found 24 examples of federal financial literacy programs and resources designed to help seniors and people with disabilities make financial decisions. Examples include curricula to prevent financial exploitation of seniors, websites with employment information for people with disabilities, and hotlines that provide information about retirement, disability, and other benefits.

Federal Financial Literacy Program for Seniors and Disabilities

The Financial Literacy and Education Improvement Act established the Commission on Financial Literacy and Education, comprised of the heads of 24 federal agencies and organizations, to improve financial literacy and education through a coordinated federal effort. The Commission does so through working groups, public meetings, and coordination of financial literacy programs and resources. The Treasury Department and the Consumer Financial Protection Bureau serve as the Commission’s chair and vice-chair, respectively, and the Commission communicates information about its efforts primarily through annual reports to Congress.

Of the 24 financial literacy programs that GAO identified as targeting seniors and people with disabilities, the Committee’s five annual reports for fiscal years 2015 through 2022 included program outcome data for one. The reports contain similarly limited outcome information for other financial literacy programs. The Committee’s national strategy emphasizes the importance of collecting data on the outcomes of financial education activities to evaluate their impact and inform data-driven improvements. Additionally, GAO’s previous work has shown that evidence-based policymaking is critical to effective program management. By focusing on outcome reporting for Federal financial literacy activities, the Committee and Congress will have stronger information to facilitate oversight of Federal financial literacy activities. More information will also help member agencies evaluate the effectiveness of their programs and help Congress determine how agencies’ efforts are meeting the needs of specific groups, such as seniors and people with disabilities.

Why did GAO conduct this investigation?

Financial literacy — the ability to make informed decisions and take effective action about money — is essential to ensuring the financial health and stability of individuals and families. Financial literacy is especially important for seniors and people with disabilities. Many Federal agencies promote financial literacy through programs and resources, including print and online materials.

GAO was asked to report on federal financial literacy programs for seniors and individuals with disabilities. The report addresses (1) the financial decisions that seniors and individuals with disabilities face and the federal resources available to help them improve their financial literacy, and (2) how the Commission on Financial Literacy and Education coordinates financial literacy efforts and reports program results to Congress and the public. GAO reviewed agency strategic plans, annual reports, websites, and other materials, and interviewed representatives of federal agencies and related organizations, including AARP and the National Institute on Disabilities.